User login

Welcome to Clarkston, Michigan

- where small-town charm meets modern living!

The CTA, BOI and FinCEN: What Does this Mean for Clarkston, MI

The Corporate Transparency Act (CTA) mandates most businesses in Clarkston, MI, to report Beneficial Ownership Information (BOI) to FinCEN, aiming to enhance transparency and deter financial crimes.

As of today, 11-26-2024, Clarkston business owners have 36 calendar days (or 27 business days) remaining to file their BOI reports with FinCEN—take action now to avoid $500 daily penalties for non-compliance!

Steps to Stay Compliant

1. Confirm if Your Business Must File

Deadline: ASAP

Most LLCs, corporations, and similar entities qualify as "reporting companies." Exceptions include banks, publicly traded companies, and nonprofits.

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners include anyone who:

-

Owns 25% or more of the company, or

-

Exercises substantial control over its operations.

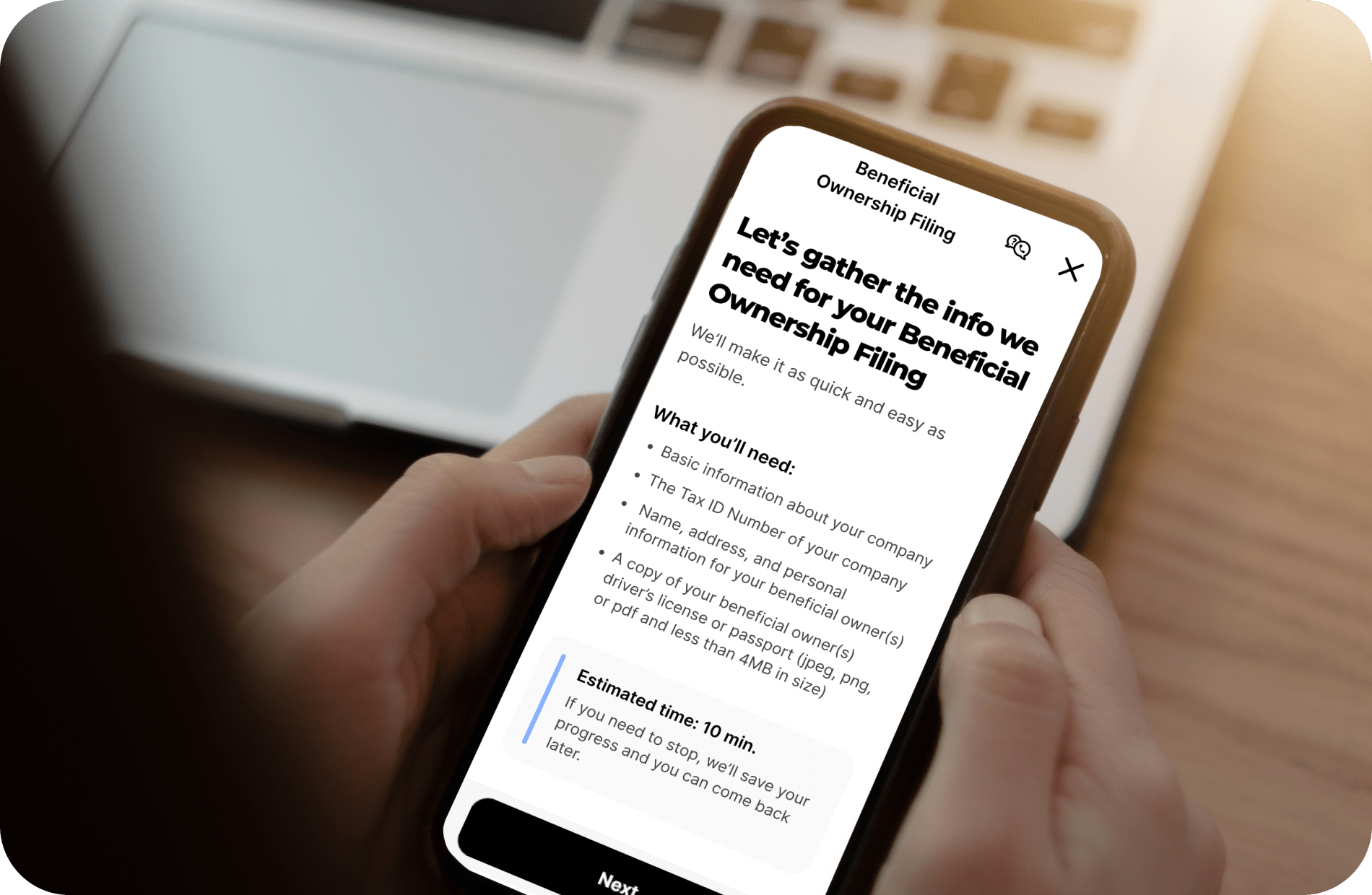

3. Gather Required Information

Deadline: 12-17-2024

Collect:

-

Company details: Name, EIN, and address.

-

Beneficial owner details: Name, address, date of birth, and ID information.

4. File Your BOI Report

Deadlines:

-

Existing companies: File by 01/01/2025.

-

New companies (2024): File within 90 days of formation.

-

New companies (2025 onward): File within 30 days of formation.

ZenBusiness simplifies filing. Click here to get started.

BOI Filing Essentials

Who Needs to File?

Most Clarkston businesses, such as a family-owned restaurant, must file unless exempt. Exemptions apply to nonprofits, banks, and publicly traded entities.

What Is a Beneficial Owner?

A beneficial owner is someone with 25% ownership or substantial control of a company. For example, in a small landscaping business owned equally by four partners, each would be considered a beneficial owner.

What Information Is Required?

You’ll need details about both the company and its beneficial owners, including:

-

Legal names.

-

Residential addresses.

-

Dates of birth.

-

Government-issued ID details.

How and When to File

All BOI reports must be submitted electronically via FinCEN’s system. Deadlines vary:

-

Companies formed before 01/01/2024 must file by 01/01/2025.

-

Companies formed in 2024 must file within 90 days of creation.

-

Companies formed in 2025 or later must file within 30 days of creation.

Penalties for Non-Compliance

Failure to file can result in fines of $500 per day or even imprisonment. FinCEN offers a 90-day safe harbor for correcting errors after filing.

Why ZenBusiness?

ZenBusiness offers streamlined BOI filing services, ensuring accuracy and compliance while saving you time. Their expertise gives Clarkston businesses peace of mind. Learn more and start today.

Additional Resources

Don’t wait—ensure your business complies before January 1, 2025!

We want to hear from you! Take our quick survey by December 18, 2024 to share your knowledge about Beneficial Ownership Information (BOI) filing. It only takes a few minutes. Plus for every 25 responses, our Chamber will receive a $100 donation! [Click here to take the survey now!] Thank you for your time and valuable feedback.

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.